Is It Cheaper to Rent or Buy in Berks County, PA? (2026 Cost Breakdown)

Renting in Berks County costs significantly less per month—typically $1,200–$1,650—compared to buying, which averages $2,500–$3,000+ once taxes, insurance, and maintenance are included. However, homeownership builds long-term wealth through equity and appreciation.

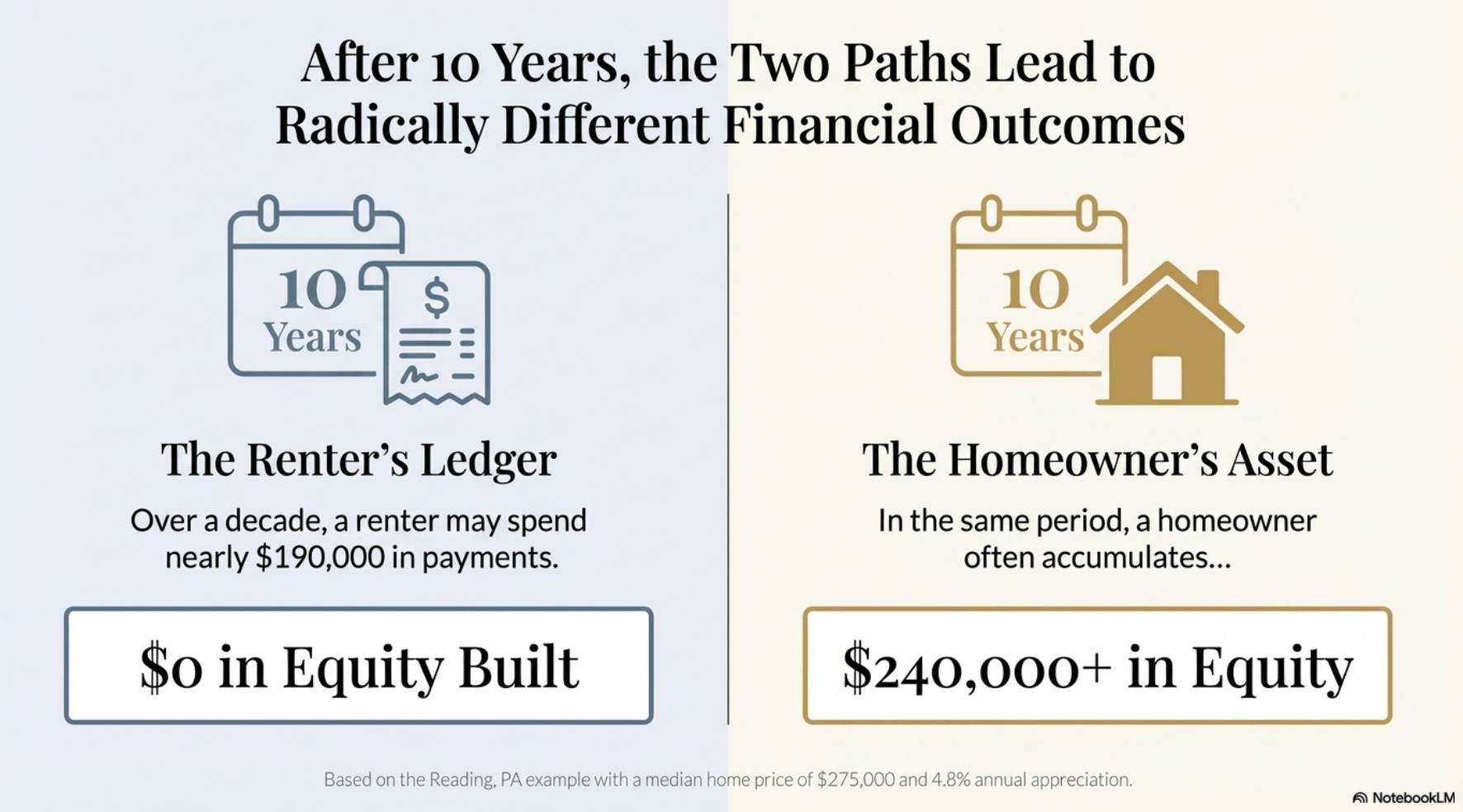

Based on Berks County’s historical 4.8% annual appreciation rate, buyers typically reach their financial break-even point around year four. By year ten, homeowners often accumulate $240,000+ in equity, while renters may spend nearly $190,000 with no asset to show for it.

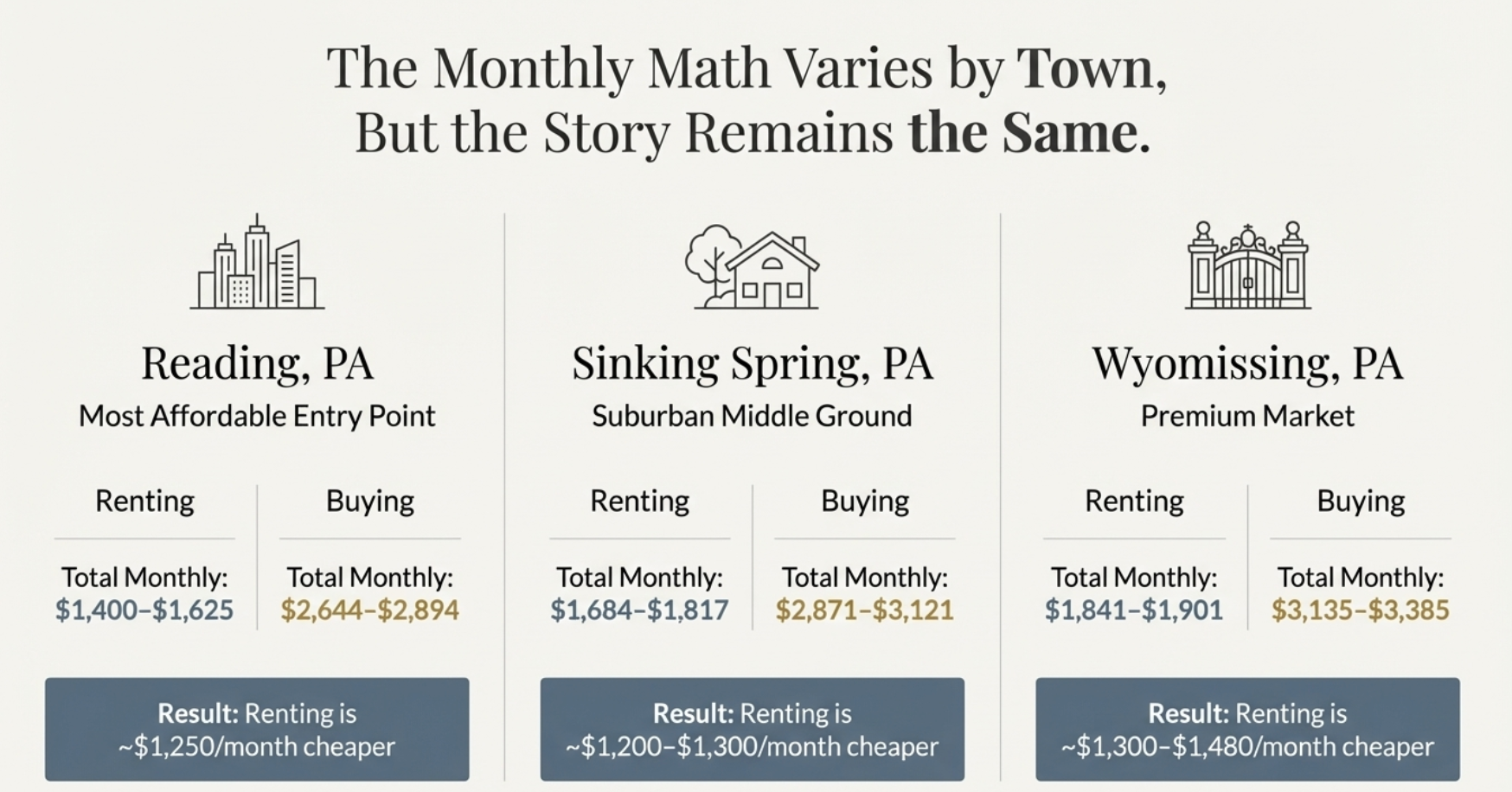

Monthly Cost Comparison: Renting vs. Buying in Berks County

Reading, PA: Most Affordable Entry Point

Renting Costs

- Average rent: $1,207/month

- Renters insurance: $15–25

- Utilities: $150–200

Total Monthly Rent: $1,400–$1,625

Buying Costs (Median Price: $275,000)

- Mortgage (10% down, 6.5%): $1,861

- Property taxes: $229

- Insurance: $125

- Maintenance reserve: $229

- Utilities: $200–250

Total Monthly Ownership: $2,644–$2,894

Result: Renting is ~$1,250/month cheaper.

Sinking Spring, PA: Suburban Middle Ground

Total Monthly Rent: $1,684–$1,817

Total Monthly Ownership: $2,871–$3,121

Result: Renting is ~$1,200–$1,300/month cheaper.

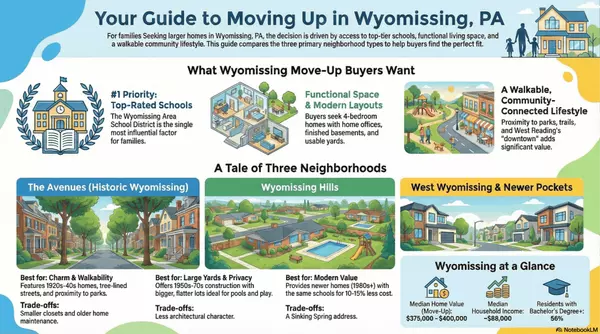

Wyomissing, PA: Premium Market

Total Monthly Rent: $1,841–$1,901

Total Monthly Ownership: $3,135–$3,385

Result: Renting is ~$1,300–$1,480/month cheaper.

Upfront Cost Comparison

| Location | Total Buyer Upfront | Typical Renter Move-In |

|---|---|---|

| Reading | $39,850 | $3,014 |

| Sinking Spring | $43,100 | $3,460 |

| Wyomissing | $46,870 | $3,722 |

Long-Term Wealth Comparison

At five years, renting remains cheaper out-of-pocket. However, homeowners accumulate substantial equity.

- 5-Year Equity (Reading example): ~$87,000

- 10-Year Equity: ~$245,000

- 10-Year Renter Equity: $0

According to Redfin market data, Berks County appreciation averages ~4.8% annually, making ownership a powerful forced-savings strategy.

See how homeowners maximize outcomes when selling by reading Maximizing Your Starter Home Sale Proceeds in Berks County.

Who Should Rent vs. Buy in Berks County

Renting Makes Sense If:

- You plan to move in under 3–4 years

- You’re rebuilding credit or saving a down payment

- You need flexibility for career changes

Buying Makes Sense If:

- You plan to stay 5+ years

- You want to build long-term equity

- You have stable income and savings

Frequently Asked Questions

When does buying become cheaper than renting in Berks County?

Financially, most buyers break even around year four when equity gains offset higher monthly costs.

What income do I need to buy a home in Berks County?

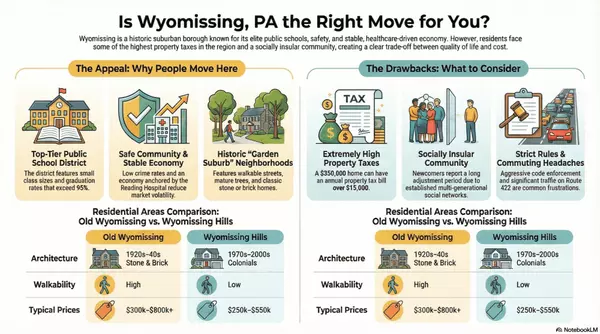

Approximately $60,000–$65,000 for Reading and $72,000–$78,000 for Wyomissing, assuming minimal other debt.

Are there first-time buyer programs?

Yes. Programs through PHFA offer up to $10,000–$15,000 in down payment assistance.

Work With a Berks County Move-Up Specialist

If you’re deciding whether to rent or buy—or planning to sell and move up—local strategy matters.

Matthew Gantkowski, Berks County Move-Up Specialist, helps families evaluate rent vs. buy decisions with real numbers, not generic advice.

📍 RE/MAX of Reading

📞 (484) 719-7000

✉️ mgantkowski@goberkscounty.com

🌐 mattsellsberks.com

Categories

Recent Posts