Berks County PA Property Tax Assessment Appeals Guide 2026

Quick Answer: Berks County Property Tax Assessment Appeals

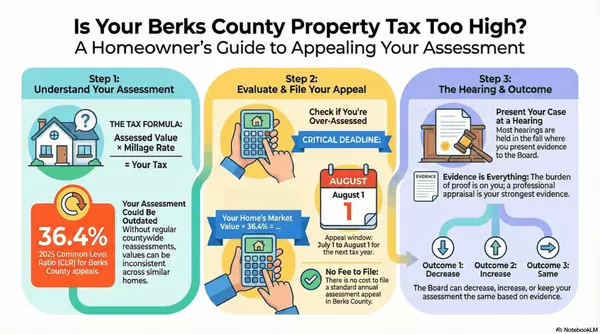

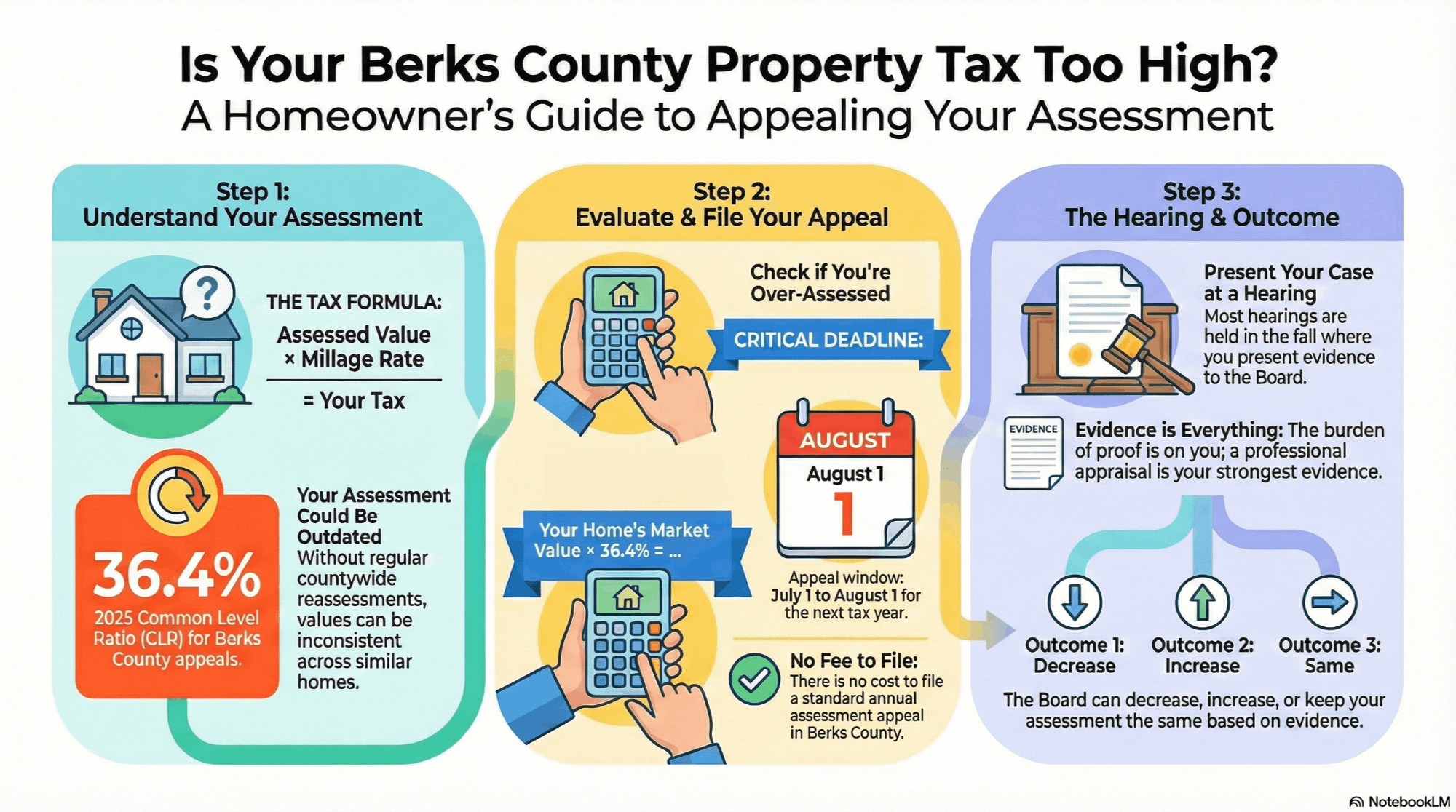

Berks County property owners can appeal their property tax assessments annually between July 1 and August 1, with the August 1 deadline applying to the following tax year. Property assessments are calculated using fair market value multiplied by the Common Level Ratio (currently 36.4% for 2025) and the millage rate. New assessments take effect January 1 of the following year, and no filing fee is required for standard appeals.

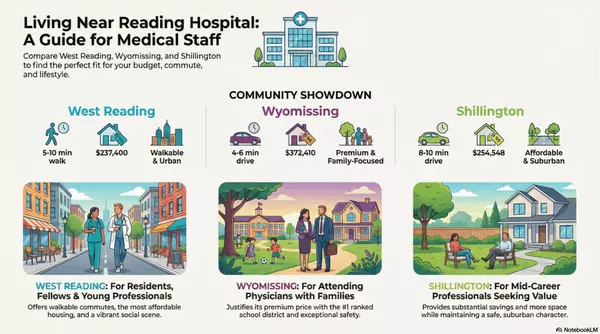

Moving to a more expensive home in Berks County means accepting a higher property tax burden—but understanding how assessments work, when new values take effect, and how to challenge them gives homeowners control over this significant expense. Property taxes represent one of the largest ongoing costs of homeownership, and assessments in Berks County can remain outdated for years without regular countywide reassessments.

This comprehensive guide explains the county's assessment system, critical appeal deadlines, required evidence, and the complete hearing process so property owners can make informed decisions about challenging their tax assessments.

How Berks County Calculates Property Tax Assessments

Property taxes in Berks County are calculated using a straightforward formula: the property's assessed value multiplied by the millage rate. The millage rate represents the combined tax rates from Berks County, the municipality, and the school district. One mill equals $1 of tax for every $1,000 of assessed value.

The Berks County Assessment Office determines each property's assessed value based on fair market value, defined as "the price a purchaser, willing but not obliged to buy, would pay an owner, willing but not obliged to sell." County assessors measure and describe all new construction and improvements to ensure accurate valuations.

Understanding the Common Level Ratio

The Common Level Ratio (CLR) plays a crucial role in Berks County's tax system. This ratio, calculated annually by the Pennsylvania State Tax Equalization Board, reflects the relationship between assessed values and actual market values in the county.

For Berks County, the CLR is currently 36.4% for appeals with an effective year of 2025. This means properties are generally assessed at approximately 36.4% of their actual market value. The CLR becomes critical during appeals because Pennsylvania's constitution requires uniform taxation at approximately the same percentage of actual value across all properties.

Because Berks County doesn't conduct regular countywide reassessments, properties can remain at outdated values for years or even decades. This creates situations where similar homes in the same neighborhood carry vastly different tax bills simply because they were last assessed at different points in the market cycle.

When New Property Tax Assessments Take Effect in Berks County

The timing of when a new assessment affects tax bills depends on whether dealing with a standard property or new construction.

For Existing Properties

Any change in assessment—whether from a successful appeal or a reassessment—becomes effective January 1 of the following year. If a property owner appeals an assessment in summer 2025 and wins, the reduced assessment will apply to the 2026 tax year, not the current tax bill.

For Newly Purchased Homes

The assessment does not change automatically based on purchase price. Tax assessments are not retroactive to the time of property purchase. Initial tax bills will reflect the property's existing assessed value, not what was paid for it.

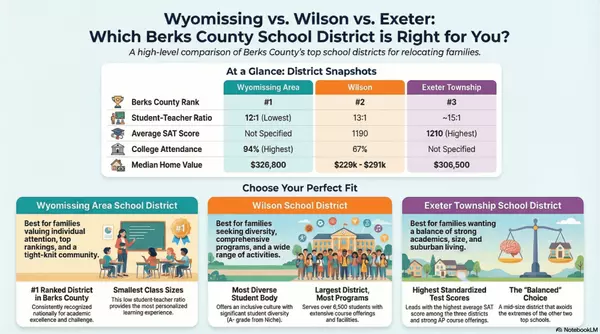

However, school districts in Pennsylvania have increasingly been filing appeals on recently sold properties where the purchase price significantly exceeds the assessed value. Homebuyers in Wyomissing and surrounding areas should anticipate potential assessment increases when purchasing above current assessed values.

For New Construction or Major Improvements

Property owners will receive an interim assessment for new construction or substantial improvements. These interim bills are prorated for the increased assessed value from when the improvement was completed.

An interim assessment is generally effective when the improvement is complete and is retroactive to the first month following completion. For example, if construction finishes in March, the interim assessment covers April through December of that year. These interim bills typically arrive 8-12 weeks after completion or settlement.

Property Tax Bill Mailing Schedule

County and township tax bills are mailed by March 1 each year, while school district bills are mailed around July 1. Each bill includes discount, face, and penalty periods—typically offering a 2% discount if paid within the first period, face amount in the second period, and penalties thereafter.

How to Check Your Current Berks County Property Assessment

Checking property assessments is straightforward. Property owners can access records and current assessments through the county's online system at paytaxonline.countyofberks.com. The parcel viewer allows searching by parcel number, location address, school district, municipality, or owner name.

Property records are public and maintained by the Assessment Office, located at 400 E. Wyomissing Ave., Mailbox 6, Mohnton, PA 19540. Contact the office at 610-478-6262 or via email at assessment@berkspa.gov.

Evaluating Assessment Accuracy

When reviewing an assessment, compare it to similar properties in the neighborhood that have sold recently. Calculate whether the property might be over-assessed by using this formula:

Fair Market Value × Common Level Ratio (36.4% for 2025) = Expected Assessed Value

If the assessed value exceeds this calculated amount, grounds may exist for an appeal.

Filing a Property Tax Assessment Appeal in Berks County

Berks County property owners have the right to file an annual assessment appeal if they believe their property is over-assessed. Unlike most Pennsylvania counties that use an August 1 deadline, Berks County's annual appeal deadline is August 1, with applications accepted only between July 1 and August 15.

Missing this narrow window means waiting another full year to appeal. For 2026 tax year appeals, the deadline is August 1, 2025.

Types of Assessment Appeals

| Appeal Type | Filing Window | Effective Date | Purpose |

|---|---|---|---|

| Annual Appeal | July 1 - August 1 | Following tax year (January 1) | Challenge current assessment based on market conditions |

| Interim Appeal | 40 days from assessment change notice | Current tax year (prorated) | Challenge increased assessment from new construction or improvements |

Required Documentation for Filing

To initiate an appeal, property owners must complete the official Berks County Assessment Appeal Form. The application requires:

- Property identification (parcel/PIN number)

- Owner information and mailing address

- Property location

- Proposed fair market value

- Supporting evidence for the claim

No filing fee is required for standard assessment appeals in Berks County. However, exemption applications carry a non-refundable $100 filing fee.

Building a Strong Appeal Case: Evidence Requirements

The burden of proof rests entirely with the property owner in assessment appeals. Sufficient, credible, and relevant evidence must be presented to establish the property's fair market value.

Acceptable Evidence for Property Tax Appeals

Professional Appraisals: A certified appraisal by a Pennsylvania-licensed appraiser provides the strongest evidence. For residential properties valued under $800,000, a detailed comparable sales report may suffice without a full appraisal. For commercial properties or high-value homes, professional appraisals are essential.

Comparable Sales Data: Recent sales of similar properties in the neighborhood form the foundation of most successful appeals. The properties should be comparable in size, age, condition, and location. School districts cannot simply submit a deed showing purchase price; they must provide proper comparable sales analysis.

Property Condition Issues: Documentation of damage, needed repairs, or factors that negatively impact value strengthens the case.

Purchase Price Considerations: While a recent purchase price is persuasive evidence, it's not conclusive on its own. The sale price must be supported by comparable sales or another valuation method.

Economic Factors: For commercial properties, income and expense data, vacancy rates, and other economic details help establish value.

Evidence must be submitted in advance of the hearing according to local rules. Copies must be provided to the assessment board and any intervening taxing authorities.

The Berks County Assessment Appeal Hearing Process

Once an appeal is filed, the Berks County Board of Assessment Appeals sets a hearing date and notifies the property owner at least 20 days in advance. Most appeals are heard in the fall, between the August deadline and October 31.

What Happens During the Hearing

At the hearing, the Board presides and examines evidence from all parties. The property owner (or their representative) must be present unless a notarized Power of Attorney has been designated. An attorney may be hired for representation, though it's not required.

The hearing process allows the Board and taxing authorities to ask questions about evidence. School districts, municipalities, and the county can intervene and oppose appeals if they believe the assessment is appropriate or even too low. Taxing districts increasingly challenge properties they believe are under-assessed, particularly recently sold properties.

Hearing Outcomes and Timeline

After the hearing, the Board deliberates and issues a written decision within approximately 3-5 days. The decision can result in three outcomes:

- Assessment reduced to the proposed value or another amount the Board determines fair

- Assessment remains unchanged

- Assessment increased if evidence shows the property was under-assessed

No one should assume that filing an appeal guarantees a reduction. The Board bases its decision solely on evidence presented.

The new assessment, whether increased, decreased, or unchanged, takes effect January 1 of the following year. For appeals filed by August 1, 2025, any changes apply to 2026 tax bills.

Appealing Beyond the Board of Assessment

If disagreeing with the Board's decision, property owners have 30 days to appeal to the Berks County Court of Common Pleas. This court appeal requires stronger evidence, typically including professional appraisals for each parcel.

At the Court of Common Pleas level, if the property owner and taxing bodies cannot reach a settlement agreement, the case proceeds to trial or an evidentiary hearing where a judge makes the final determination of value. Most cases settle before trial once all parties review the evidence.

Decisions from Common Pleas can be further appealed to the Commonwealth Court, though this level involves complex legal issues and is typically pursued only for high-value properties or cases establishing important precedents.

Homestead Exemption Program in Berks County

Berks County property owners can reduce their school district tax burden through the Homestead/Farmstead Exclusion Program. This state program provides property tax relief to homeowners whose property serves as their primary residence.

Eligibility Requirements

To qualify, the property must be the primary residence, and the owner cannot receive homestead reduction from any other county or state. If operating an in-home business, the homestead reduction applies only to the percentage of the home used as the primary residence.

Application Deadlines

Applications must be filed with the Berks County Assessment Office by March 1 to receive the exclusion for the following tax year beginning July 1. School districts are required to notify homeowners by December 31 each year if their property isn't currently approved or if approval is due to expire.

Once approved, homeowners generally don't need to resubmit applications for at least three years unless circumstances change. The homestead exclusion reduces the taxable assessed value of the property for school tax purposes, resulting in direct tax savings.

For properties with more than 10 acres and agricultural outbuildings, farmstead relief may also apply. Contact the Assessment Office at 610-478-6262 or assessment@berkspa.gov for application forms and specific eligibility requirements.

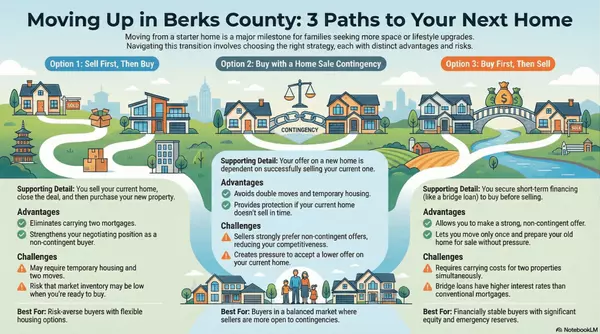

Strategic Tax Planning for Berks County Homebuyers

Understanding assessment principles helps first-time homebuyers and move-up buyers budget accurately and plan strategically.

Budget for Potential Tax Increases

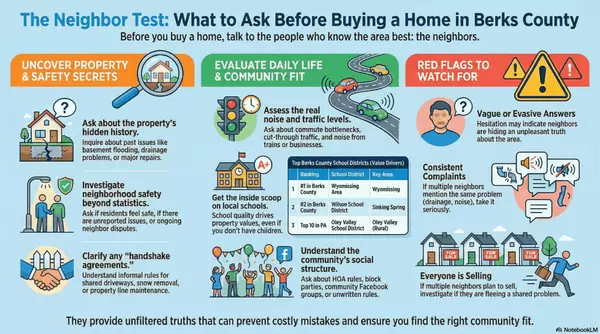

When buying in Wyomissing, Reading, or Sinking Spring at a price significantly higher than the current assessed value, anticipate that the school district may file an assessment appeal to increase taxes. This has become standard practice in many Pennsylvania districts.

Mark Critical Deadlines

Appeals filed by August 1, 2025 affect 2026 taxes. When purchasing in late 2025, the first opportunity to appeal won't be until summer 2026 for 2027 taxes. The July 1-August 1 appeal window in Berks County is narrow and unforgiving.

Consider Getting an Appraisal

When buying a property believed to be over-assessed, order an appraisal during the purchase. This appraisal can support a future assessment appeal. Even purchase appraisals can sometimes be used as supporting evidence, though appeal-specific appraisals carry more weight.

Research Comparable Sales

Before closing, research what similar properties in the neighborhood have sold for and what their assessments are. This gives advance warning if the new property is likely to be reassessed upward.

Apply for Homestead Exemption Immediately

File the homestead application by March 1 of the first year of ownership to maximize tax savings beginning the following July.

Review Interim Assessments Carefully

For new construction or substantial renovations, scrutinize interim assessment notices. Only 40 days exist to appeal these increases.

Frequently Asked Questions About Berks County Property Tax Assessments

Can I appeal my property tax assessment in Berks County every year?

Yes, property owners can file an annual assessment appeal every year between July 1 and August 1. The appeal affects the following tax year. However, filing an appeal doesn't guarantee a reduction, and assessments can potentially increase if evidence shows the property is under-assessed.

Does my property tax increase automatically when I buy a home in Berks County?

No, property tax assessments are not automatically adjusted based on purchase price. However, school districts frequently file appeals on recently sold properties when the purchase price significantly exceeds the assessed value, which can result in increased taxes for the following year.

How long does the Berks County property tax appeal process take?

Appeals filed between July 1 and August 1 are typically heard between August and October 31. The Board of Assessment Appeals issues a written decision within approximately 3-5 days after the hearing. Any approved changes take effect January 1 of the following year.

Contact Information and Resources

Berks County Assessment Office

400 E. Wyomissing Ave., Mailbox 6

Mohnton, PA 19540

Phone: 610-478-6262

Email: assessment@berkspa.gov

Website: www.berkspa.gov/departments/assessment

Online Property Records: paytaxonline.countyofberks.com

Appeal Forms: www.berkspa.gov/departments/assessment/forms

Common Level Ratio Information: www.berkspa.gov/departments/assessment/clr

Tax Payment Information: www.berkspa.gov/departments/treasurer

Partner With a Local Expert Who Understands Berks County Property Taxes

Understanding how Berks County assesses property taxes, when changes take effect, and how to effectively challenge unfair assessments empowers homeowners to manage one of homeownership's largest ongoing expenses. With assessment appeals affecting taxes for years to come, taking the time to verify assessment accuracy and file timely appeals when warranted can generate thousands of dollars in savings throughout the homeownership journey.

For homeowners considering selling their starter home or buying and selling simultaneously, understanding property tax implications is crucial for accurate budgeting. Whether evaluating Reading, Sinking Spring, or the Wyomissing real estate market, local expertise makes the difference in navigating property tax complexities.

About the Author

Matthew Gantkowski | Your Berks County Move-Up Specialist

License ID: RS366252

Hi, I'm Matthew Gantkowski, your Berks County neighbor, real estate strategist, and move-up transition specialist. As a lifelong resident of this community, I've spent my entire life exploring every neighborhood from Wyomissing to Kutztown, giving me an insider's perspective that only comes from truly living here.

What sets me apart? My background in team management and customer relations gives me a unique approach to real estate. I don't just list properties—I craft strategic marketing plans that showcase your home's story and attract serious buyers willing to pay premium prices. Whether you're a first-time buyer stepping into homeownership or upgrading from a starter home to your forever property, I'm here to guide you through every step.

My commitment is simple: Be your trusted resource not just for this transaction, but for all your real estate needs as your life evolves in Berks County.

Professional Track Record:

- 3+ years serving Berks County (since October 2022)

- 43+ successful transactions across southeastern Pennsylvania

- Consistent 5-star client satisfaction across all platforms

- Specialized expertise in Wyomissing, Reading, Kutztown, and surrounding Berks County communities

- Top producing agent in rural markets including Kutztown, Barto, and Elverson specializing in larger acreage properties and farms

- RE/MAX of Reading Team Member

- Expert in first-time homebuyers and move-up transitions

- Serving Berks County and surrounding southeastern Pennsylvania markets

Why Berks County Families Trust Matthew Gantkowski

Local Knowledge That Matters

Born and raised in Berks County, I bring decades of neighborhood knowledge that out-of-area agents simply can't match. I know which streets have the best school access, where property values are climbing, and which communities fit your lifestyle—from suburban Wyomissing to rural properties with larger acreage 30 minutes out.

Strategic Marketing That Sells

I create customized marketing strategies designed to position your home for maximum exposure and top dollar, not just generic listing photos and hoping for the best.

Honest, Unfiltered Guidance

No sales pressure, no games. I tell you exactly what buyers see, what needs attention, and what returns the best investment so you make confident decisions backed by local market data.

Seamless Move-Up Coordination

Selling and buying simultaneously? I orchestrate the timing, negotiate contingencies, and manage both transactions so you transition smoothly without the stress of temporary housing or double moves.

Contact Matthew:

📍 RE/MAX of Reading

1290 Broadcasting Road, Wyomissing, PA 19610

📞 (484) 719-7000

✉️ mgantkowski@goberkscounty.com

🌐 mattsellsberks.com

Ready to make your move? Let's discuss how I can help you navigate the Berks County market with confidence.

Categories

Recent Posts