How to Buy a New Home Using Your Equity in Wyomissing, PA

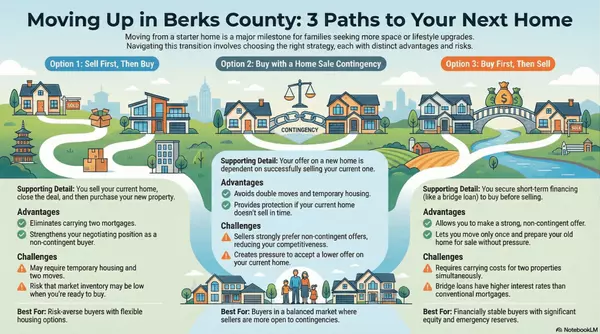

Quick Answer: Using Home Equity to Buy in Wyomissing

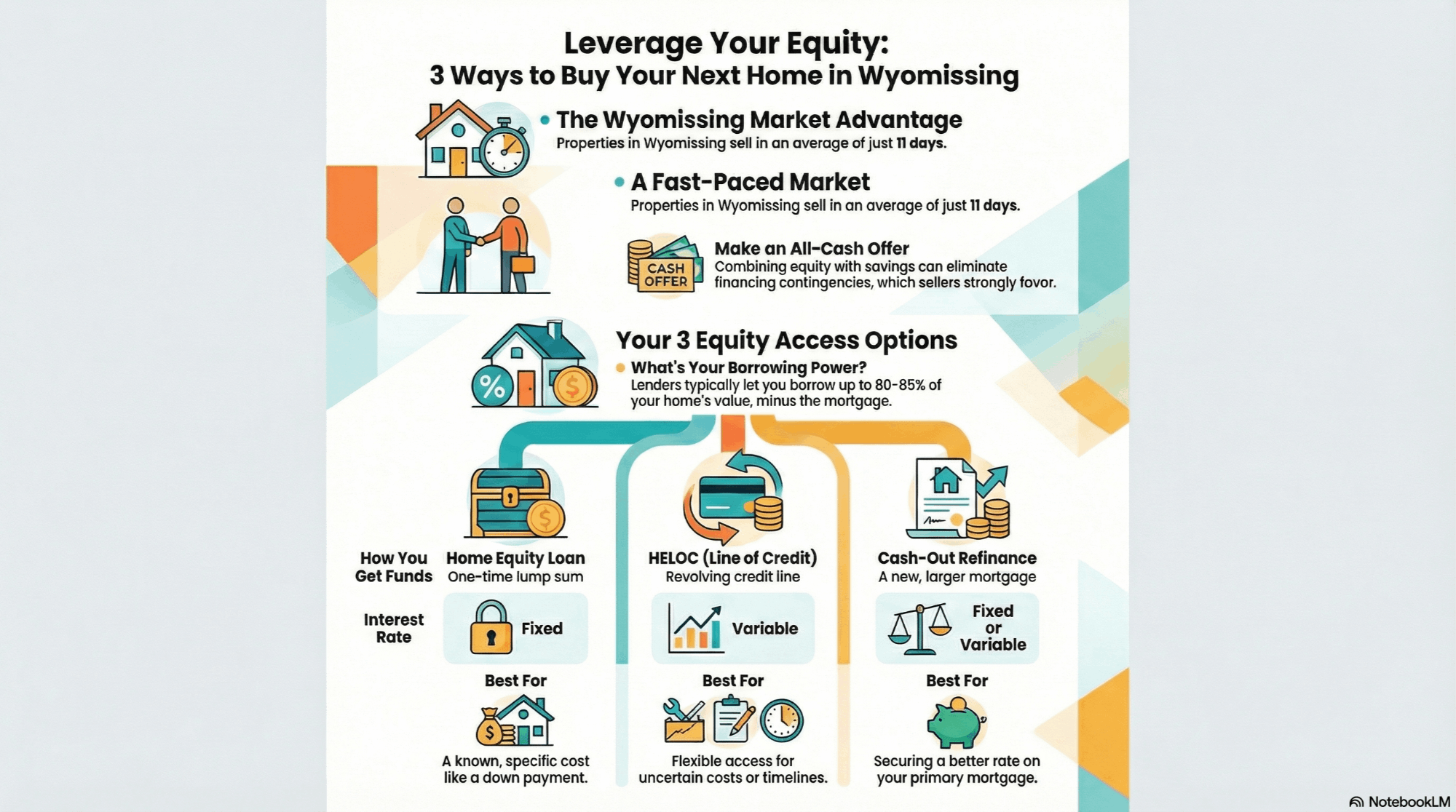

Home equity represents the difference between a property's current market value and the outstanding mortgage balance. Homeowners in Wyomissing can use this equity through three main methods: home equity loans, HELOCs, or cash-out refinancing. These strategies allow buyers to compete in Wyomissing’s fast-moving market, where homes average just 11 days on market.

Understanding Home Equity and Its Role in Real Estate Transactions

Home equity accumulates through three primary mechanisms: the initial down payment, monthly principal reduction on the mortgage, and market appreciation. In Berks County, residential properties have demonstrated consistent appreciation patterns, with countywide values projected to increase 1.0% in Q1 2026 according to recent market forecasts.

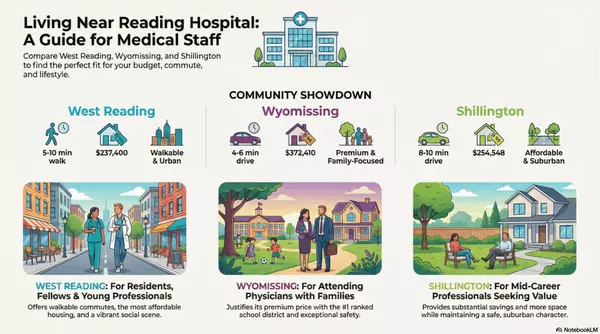

For Wyomissing specifically, the median home value reached $372,410 as of recent data, creating substantial equity opportunities for existing homeowners.

Example: How Much Equity Do You Really Have?

A home purchased for $300,000 with a $240,000 mortgage that’s now worth $370,000 with a $220,000 balance has approximately $150,000 in usable equity, depending on lender LTV limits.

Three Primary Methods to Access Home Equity

Home Equity Loan Structure and Benefits

A home equity loan functions as a second mortgage providing a one-time lump sum with a fixed interest rate and predetermined repayment schedule.

- Fixed interest rates typically between 6.5%–9.5%

- Borrowing limits up to 80–85% LTV

- Closing costs averaging 2–5%

- Predictable monthly payments

- Potential tax deductibility (consult a tax professional)

Best For:

Buyers who know exactly how much they need for a down payment or want certainty in monthly payments.

Home Equity Line of Credit (HELOC) Flexibility

HELOCs operate as revolving credit lines secured by home equity, offering flexibility for buyers with uncertain timelines.

- 5–10 year draw period

- 10–20 year repayment period

- Variable interest rates

- Interest charged only on funds used

Local lenders like Discovery Federal Credit Union, Diamond Credit Union, and Riverfront Federal Credit Union offer competitive HELOC options tailored to Berks County homeowners.

Cash-Out Refinance Considerations

Cash-out refinancing replaces your existing mortgage with a larger one, providing cash from your equity.

- Up to 80% LTV

- Single monthly payment

- 35–45 day processing timeline

Important Warning

If your current mortgage rate is below 4%, refinancing into a 6%+ loan may significantly increase monthly payments.

The Wyomissing Real Estate Market Context

Wyomissing remains one of Berks County’s most competitive housing markets. The median sale price reached $329,000 with homes averaging just 11 days on market.

Learn more about current conditions in the Wyomissing real estate market .

Why Equity Buyers Win

- Faster closings

- Stronger offers

- Ability to waive financing contingencies

Frequently Asked Questions

Can home equity be used for a down payment on a second home?

Yes. Homeowners can use equity via HELOCs, home equity loans, or cash-out refinancing while keeping their current property, provided they qualify and maintain required equity levels.

Is a HELOC or home equity loan better?

HELOCs offer flexibility with variable rates, while home equity loans provide fixed payments. The best option depends on certainty, risk tolerance, and timeline.

What credit score is needed?

Most lenders require at least a 620 score, with the best rates available at 720+.

About the Author

Matthew Gantkowski | Berks County Move-Up Specialist

License ID: RS366252

Matthew specializes in helping Wyomissing homeowners leverage equity to buy before selling, avoid double moves, and win in competitive markets.

Website: mattsellsberks.com

Brokerage Disclosure: Matthew Gantkowski is a licensed real estate professional affiliated with RE/MAX of Reading, located at 1290 Broadcasting Rd Wyomissing, PA 19610. License number: RS366252 . All information provided herein is for informational and educational purposes only and should not be construed as legal, tax, or financial advice. Readers should consult with a qualified mortgage lender and legal professional to determine the feasibility and risk of any equity-based financing strategy.

Categories

Recent Posts