First-Time Home Buyer Programs in Berks County PA: Complete 2026 Guide

Updated: December 2025

Who This Guide Is For

- Renters in Berks County struggling with down payments or closing costs

- First-time buyers confused by PHFA, FHA, VA, and USDA loan options

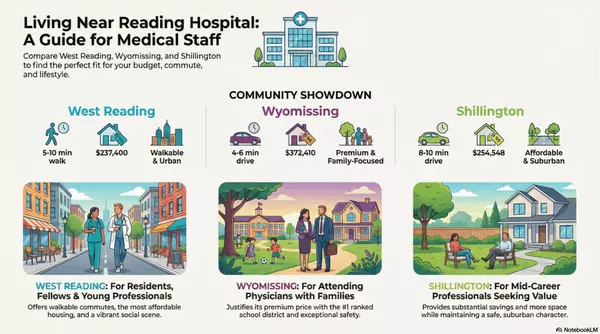

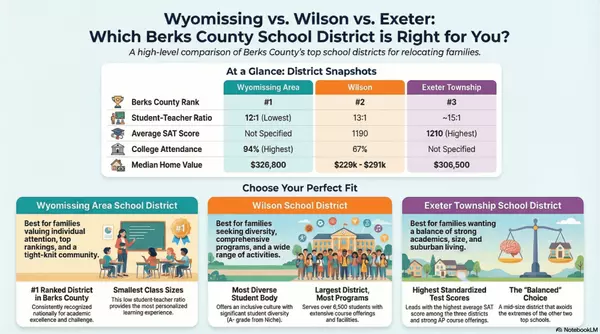

- Buyers exploring Wyomissing real estate, Reading, Sinking Spring, Kutztown, and nearby towns

- Veterans, first-generation buyers, and households seeking grants or forgivable assistance

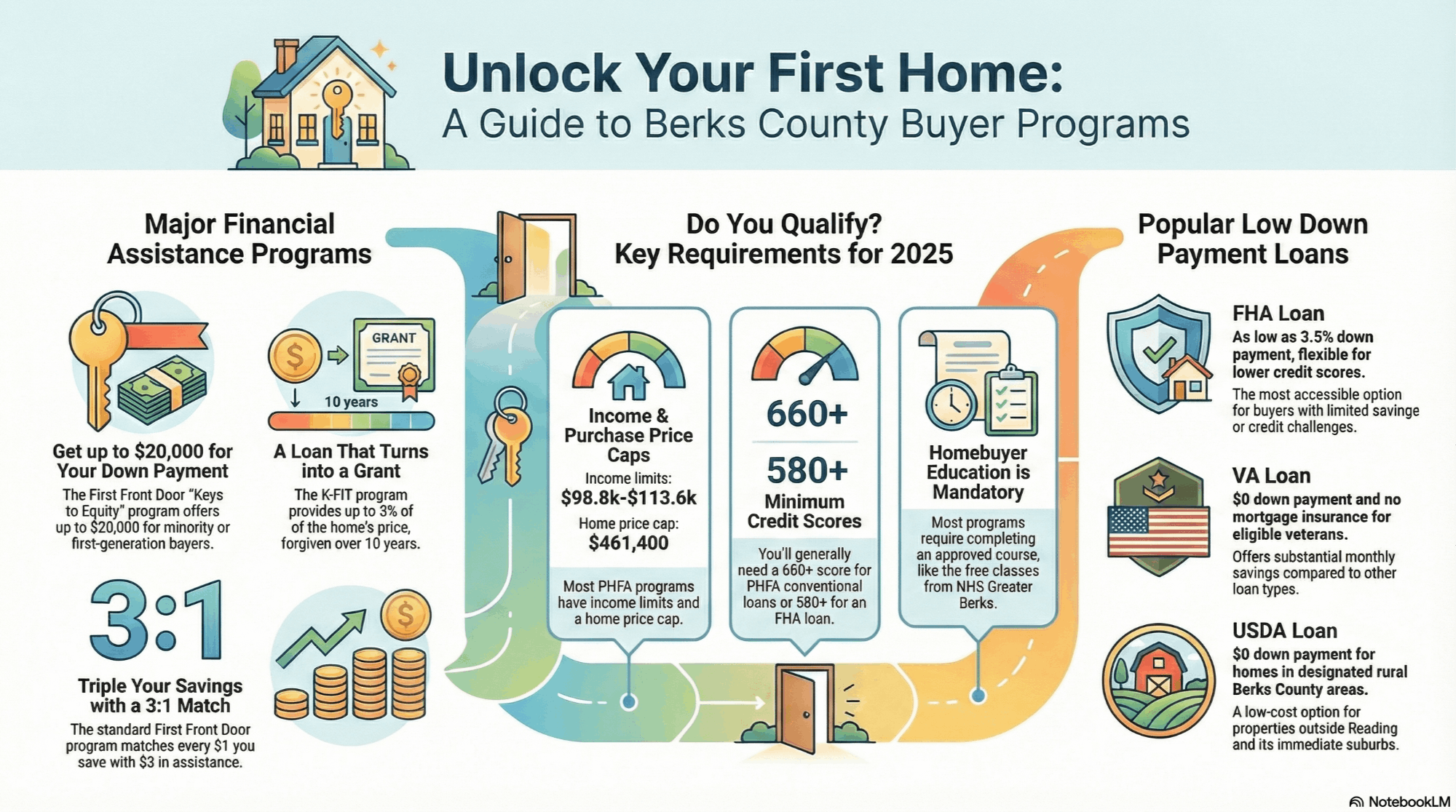

Short answer: Yes — most first-time buyers in Berks County can qualify for $3,000–$20,000 in down payment assistance in 2025, even with average credit.

- ✔ Income limits up to $113,600

- ✔ Purchase prices up to $461,400

- ✔ Zero-down options available (VA & USDA)

- ✔ Forgivable assistance available (K-FIT & First Front Door)

First-time home buyer programs in Berks County, PA provide down payment assistance ranging from $3,000 to $20,000, reduced mortgage insurance, zero-interest loans, and required homebuyer education through the Pennsylvania Housing Finance Agency (PHFA), local nonprofits, and federal programs.

What First-Time Home Buyer Programs Are Available in Berks County PA?

Pennsylvania Housing Finance Agency (PHFA)

- HFA Preferred (Lo MI): Reduced PMI with $500 grant

- Keystone Home Loan: FHA, VA, USDA, or conventional options

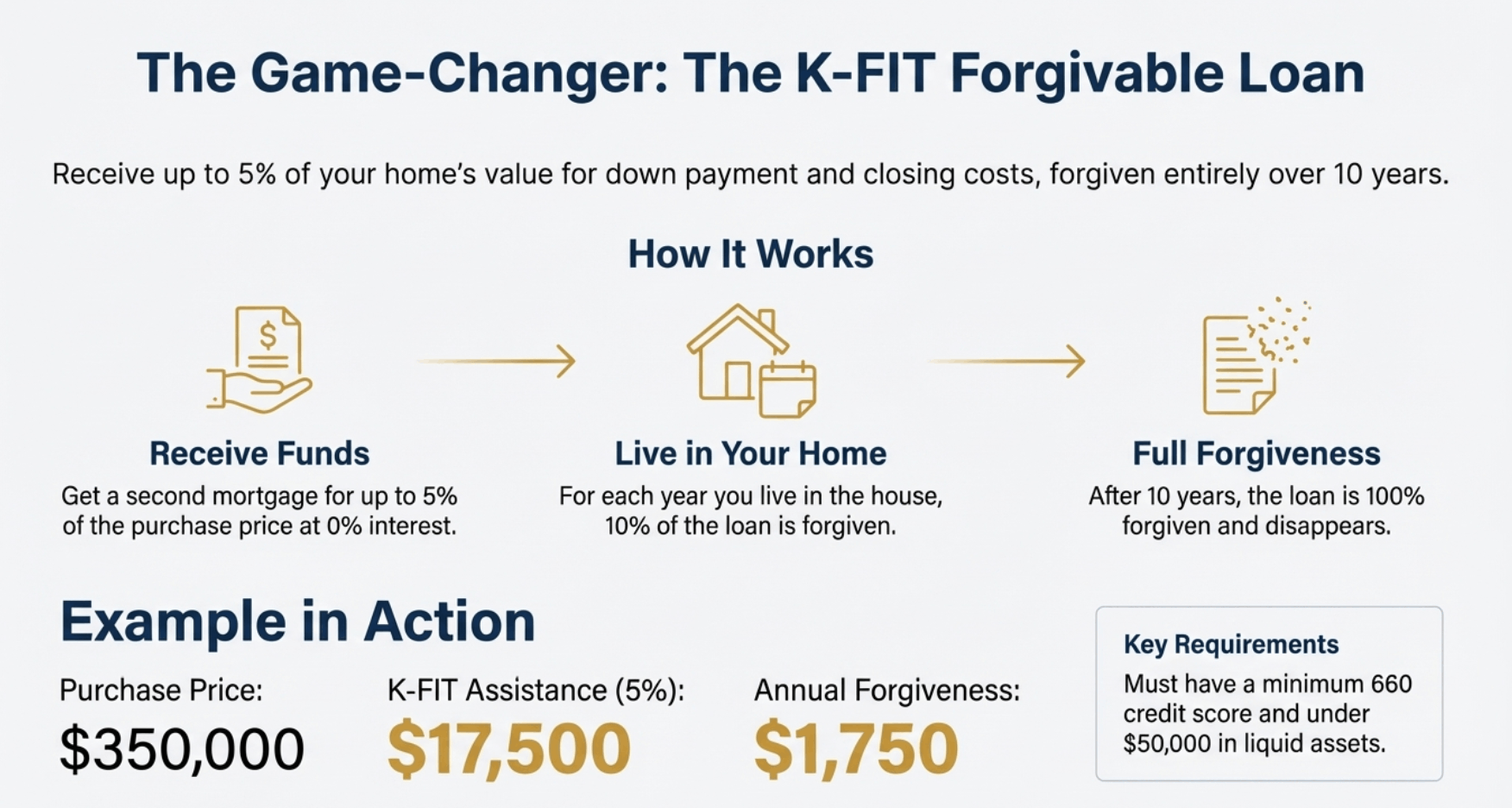

- Keystone Forgivable in Ten Years (K-FIT): Up to 5% assistance, forgivable over 10 years

- Keystone Advantage: Up to $6,000 with structured repayment

2025 update: Berks County is currently ineligible for the HOMEstead program. Buyers should focus on K-FIT, Keystone Advantage, or ACCESS programs instead.

First Front Door (FHLBank Pittsburgh)

- Standard First Front Door: 3:1 match up to $15,000

- Keys to Equity: Up to $20,000 for minority or first-generation buyers

Neighborhood Housing Services of Greater Berks

NHS Greater Berks provides free FASTRAC homebuyer education, credit counseling, and down payment assistance while satisfying PHFA education requirements.

Habitat for Humanity of Berks County

Offers affordable homes with income-based payments, sweat equity requirements, and long-term affordability for qualifying families.

City of Reading HOME Program

Available only within Reading city limits for households earning 80% AMI or less.

Berks County First-Time Buyer Program Comparison (2025)

| Program | Max Assistance | Forgivable? | Best For |

|---|---|---|---|

| K-FIT | 5% of purchase price | Yes (10 years) | Long-term homeowners |

| First Front Door | $15,000 | Yes (5 years) | Buyers with savings |

| Keys to Equity | $20,000 | Yes | Minority / first-gen buyers |

| VA Loan | $0 down | N/A | Veterans |

| USDA Loan | $0 down | No | Rural Berks County |

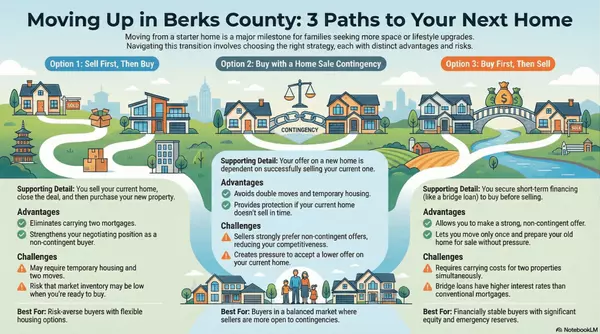

Which First-Time Buyer Program Is Best for Me?

- Veteran or active-duty? → VA Loan

- Buying outside Reading? → USDA Loan

- Planning to stay 7–10+ years? → K-FIT

- Minority or first-generation buyer? → Keys to Equity

- Lower credit score? → FHA loan + PHFA assistance

🏆 Best Overall First-Time Buyer Program in Berks County (2025): PHFA K-FIT

K-FIT delivers the highest long-term value with forgivable assistance, no interest, and no dollar cap — making it ideal for buyers planning to stay put.

Federal Loan Programs for Berks County Buyers

- FHA Loans: 3.5% down with flexible credit

- VA Loans: 0% down, no mortgage insurance

- USDA Loans: 0% down for eligible rural areas

How to Qualify for First-Time Buyer Programs

- Income limits: $98,800–$113,600

- Purchase price limit: $461,400

- Credit scores: 580–660+

- Homebuyer education required through NHS Greater Berks

Step-by-Step Application Process

- Complete homebuyer education

- Review credit and finances

- Get pre-approved with a PHFA lender

- Shop for qualifying homes

- Coordinate assistance programs

- Close on your home

Frequently Asked Questions

Can I combine multiple first-time buyer programs?

Yes. Many buyers combine PHFA loans with K-FIT or First Front Door assistance.

What happens if I sell before forgiveness?

You must repay the unforgiven portion at sale.

Do I qualify if I owned a home before?

You may qualify if you haven’t owned a home in the past three years or meet PHFA exceptions.

Work With Matthew Gantkowski

Matthew Gantkowski helps first-time buyers navigate Berks County real estate, PHFA programs, and qualifying properties.

Matthew Gantkowski | RE/MAX of Reading

License ID: RS366252

📞 (484) 719-7000

✉️ mgantkowski@goberkscounty.com

🌐 mattsellsberks.com

This guide is for educational purposes only. Program rules change annually. Always verify eligibility with PHFA-approved lenders.

Categories

Recent Posts