How to Buy and Sell a Home at the Same Time in Berks County PA (2026)

Who This Guide Is For

- Homeowners moving up to a larger home in Berks County

- Sellers who need equity from their current home to buy next

- Families relocating within Wyomissing, Reading, or Sinking Spring

- Buyers worried about double mortgages or timing risks

Quick answer: Most Berks County homeowners buy and sell at the same time using one of four strategies — concurrent closings, sale contingencies, bridge loans, or HELOCs. The right choice depends on local market speed, available equity, and risk tolerance.

- ✔ Avoid double moves

- ✔ Protect against two mortgages

- ✔ Stay competitive in hot markets like Wyomissing

Buying and selling a home simultaneously in Berks County requires careful coordination of financing, timing, and market conditions. When done correctly, homeowners can transition smoothly without temporary housing, double moves, or excessive financial strain.

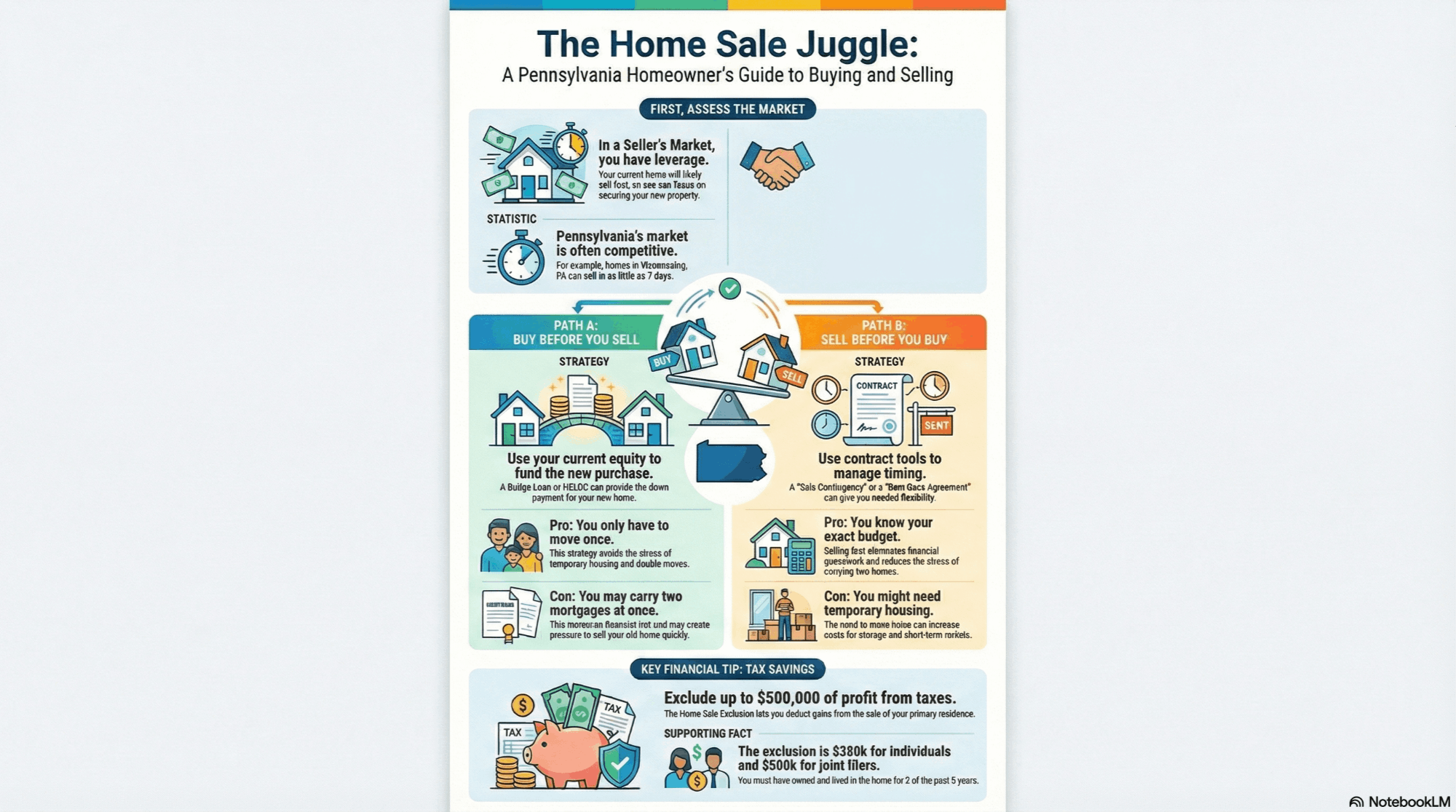

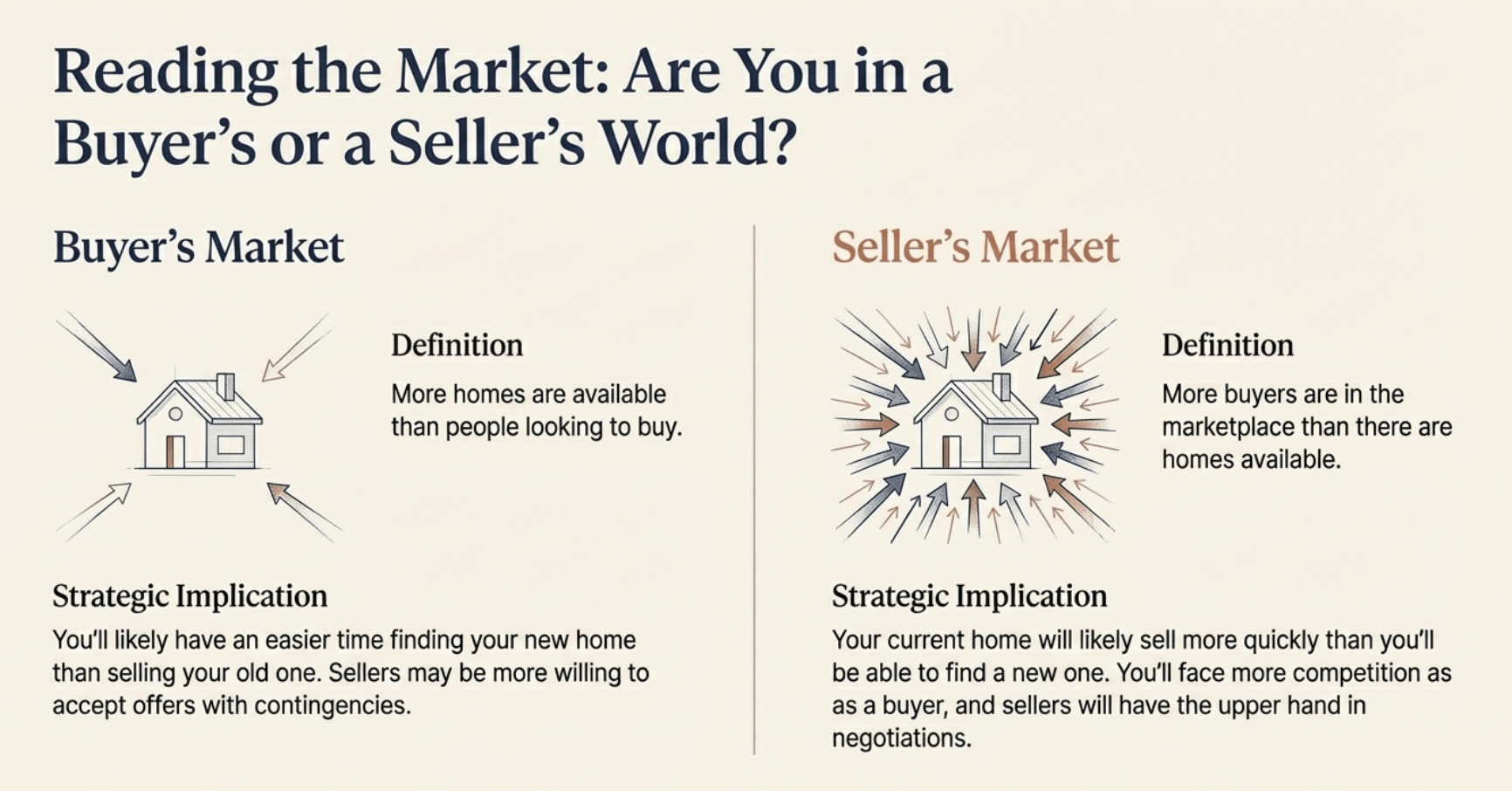

Understanding the Berks County Real Estate Market

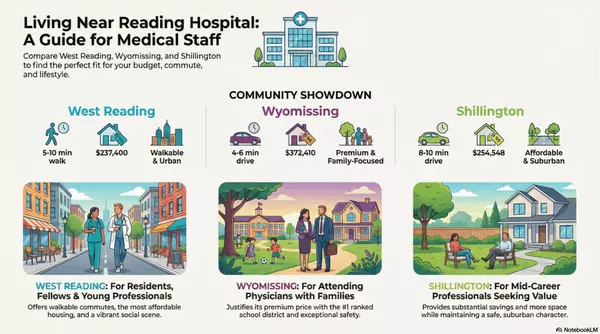

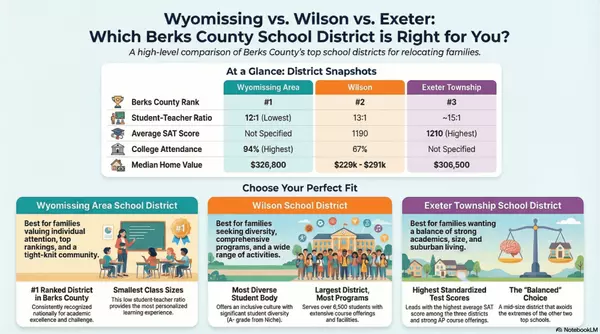

Market conditions determine which strategy works best. In fast-moving areas like Wyomissing, homes often sell in under two weeks, while Reading and Sinking Spring offer more flexibility.

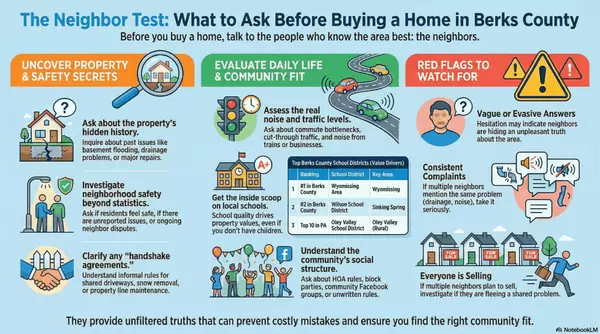

Knowing how quickly your current home will sell — and how competitive your purchase market is — dictates whether contingencies will be accepted or if non-contingent financing is required.

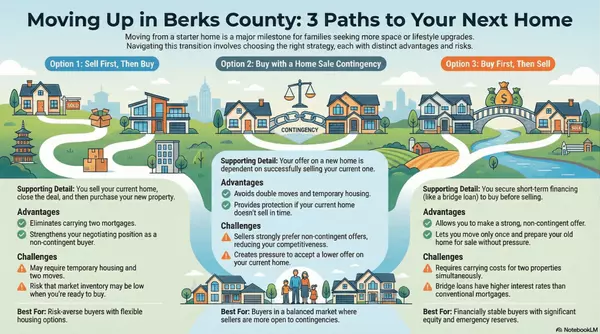

Four Primary Strategies to Buy and Sell at the Same Time

1. Concurrent Closings

Sell your current home and buy your next within the same 24–48 hours. Sale proceeds fund the new purchase.

- ✔ No temporary housing

- ✔ Single move

- ⚠ High coordination risk if delays occur

2. Home Sale Contingency

Your purchase depends on selling your current home first. Safer financially, but less competitive.

- ✔ No double mortgage risk

- ⚠ Often rejected in hot markets

- ⚠ Subject to kick-out clauses

3. Bridge Loan

Short-term financing that uses existing home equity to buy before selling.

- ✔ Non-contingent offers

- ✔ Strong negotiating power

- ⚠ Higher interest and fees

4. HELOC

Borrow only what you need against your current home’s equity.

- ✔ Lower cost than bridge loans

- ✔ Flexible draw amounts

- ⚠ Variable interest rate risk

Step-by-Step Timeline for Simultaneous Transactions

- Secure mortgage pre-approval and equity analysis

- Select an agent experienced with dual transactions

- Prepare and list your current home

- Begin targeted house hunting

- Coordinate inspections and appraisals

- Schedule closings with buffer time

Pro Tip: Using the same title company for both transactions reduces wire delays and closing-day risk.

Managing the Transition Between Homes

When timing doesn’t align perfectly, options include:

- Seller rent-back agreements

- Short-term rentals or extended-stay hotels

- Portable storage between closings

Budget for moving costs, temporary housing, and overlapping utilities. In Berks County, moving expenses typically range from $3,500–$8,000 depending on distance and volume.

Risks, Delays & Contingency Planning

- Sale delays affecting purchase closings

- Appraisal gaps

- Unexpected repair negotiations

- Carrying two mortgages temporarily

Strong backup plans — including emergency reserves and pre-approved financing alternatives — reduce stress and protect your purchase.

Frequently Asked Questions

Can I buy before selling my home in Berks County?

Yes, but most buyers need a bridge loan, HELOC, or contingency strategy to manage equity and risk.

What if my home doesn’t sell in time?

Without a contingency, you may carry two mortgages. This is why reserves and backup financing matter.

Are sale contingencies accepted in Wyomissing?

Rarely in competitive segments. Settlement contingencies are more acceptable than pure sale contingencies.

Work With a Berks County Move-Up Specialist

Matthew Gantkowski specializes in coordinating buy-sell transitions across Berks County, helping homeowners move up without unnecessary risk or stress.

Matthew Gantkowski | RE/MAX of Reading

License ID: RS366252

📞 (484) 719-7000

✉️ mgantkowski@goberkscounty.com

🌐 mattsellsberks.com

This guide is for educational purposes only and does not constitute legal or financial advice.

Categories

Recent Posts